Succession Planning Checklist for CEOs and Executives

Boards need an identifiable framework that drives senior executive development. The top leadership of the company needs to align with the strategic needs of the company. Strategic succession planning sets the company up for sound leadership on a continual basis. In addition, it gives the current CEO an opportunity to adjust his or her actions in light of the changing business conditions and strategic priorities as the succession planning committee shares an ongoing analysis of the job requirements. Still another benefit of an identifiable succession plan strengthens the relationship between the board and senior management team as they continue the process of regularly reviewing CEO candidates for the future. The first step in succession planning is for boards to determine which committee is the best suited to the task. They may choose to delegate it to the governance committee, the compensation committee or a special ad hoc committee. The lead director is often the single point of contact between the board and the current CEO. The role of the current CEO primarily rests with reviewing internal candidates. The next step is to create a written succession plan that details how company officers are elected and replaced, including how the committee should go about choosing successors. Since all vacancies won’t be planned, committees will also need to identify an emergency succession procedure. A written succession plan will ensure that the board has an orderly process for transition while alleviating unnecessary concern over destabilizing the company. Once the succession plan has been established and put in writing, it’s time for the committee to determine the requirements of the position they’re filling. The company will have a strategy for the current time and one that looks forward for 5-15 years. CEOs and senior executives will face challenges in the globalization of supply chains, customers, investors and competitors, and will need to identify risks and opportunities that accompany these issues. It’s important for committees to factor these issues in devising a list of required capabilities. Committees should consider that it will take about three years to identify a qualified CEO replacement. This will give them plenty of time to compare the list of capabilities with the firm’s senior talent pipeline. It also allows time to assess internal candidates and observe them through site visits. The information the committee collects through this process will help them revise the leadership development plan of internal candidates. This stage presents an opportunity for the company to expose candidates to multiple aspects of the business and give them responsibility for key initiatives that are similar to the types of challenges they will face as a future CEO. About two years before a planned CEO transition, the committee should be able to narrow the list to the final 2-3 candidates. At this point, they’re ready for full input from the board and CEO. The year prior to the transition is the time to assess the finalists. The full board should have an opportunity to conduct focused interviews and make a final decision. Following is a basic checklist for succession planning for the CEO and senior executives:

Succession Planning Checklist for Boards and Committees

The right board composition makes a huge difference in strong governance and corporate success. Boards can optimize their composition by finding the right people to reflect the strategic priorities of the shareholders. Corporations have to change to meet the needs of a volatile economic market and unprecedented changes in society. It’s imperative to build boards and committees that align with the strategic plan. Succession planning may include reconsidering the size and structure of the board to set the stage for where the company is going rather than where it’s been.

Corporate markets have experienced much change in recent years and will likely face even more change moving forward. To create a well-composed board, succession planning committees will need to be forward-thinking and anticipate the leadership needs of the company over the next 3-5 years, at a minimum. This approach will position the board into being proactive rather than reactive in the event of a future crisis. Having a forward-thinking approach will also help boards deal with shifting compliance and regulatory changes.

What skills will your board need moving forward? The potential shifts in the marketplace will help to answer that question. Have you considered what the future will bring as far as technology, cybersecurity, audits, risks, and compliance? As the company grows, the board needs to recruit board directors that understand the complexities of today’s business and governance models. This is the best time to consider whether it’s the right time to bring in a specialist for a future niche area of the business.  Fiduciary duties are important all the time — and they’re especially important during the time of succession planning. Boards have a fiduciary duty to investors who expect to be served by a committed and qualified board of directors that is also committed to diversity. Investors are looking for assurance their money is being invested wisely for the short and long terms.

Technology will certainly play an even stronger role moving forward. Boards will need to decide on the best way to incorporate technological expertise on the board. Many boards have overlooked the benefits that technology can offer for the company and the board. Electronic tools of the future haven’t even been invented yet. Boards will want to know that they’re well-educated and positioned to choose the best tools and maximize their dollars to take advantage of the most useful digital programs to help them take the company to the next level.

Succession planning should be driven by board self-evaluations, among other things. Advance planning provides opportunities to detect gaps in skills and abilities and identify areas where boards can encourage training and development for current staff internal advancement.

Governance committees often take the lead in succession planning, with much input from the board chair. Investors and regulators are increasingly asking boards about director succession. Independent board directors will surely play a major role in boards and governance in the near future. Meaningful succession planning will need to factor the company’s stage of development and the expectation and need for adding more independent directors.

The rapid pace of changes in the marketplace, along with technological advancements, ESG concerns and other factors, means that boards should not only establish a succession plan but that they should also review it on a regular basis.

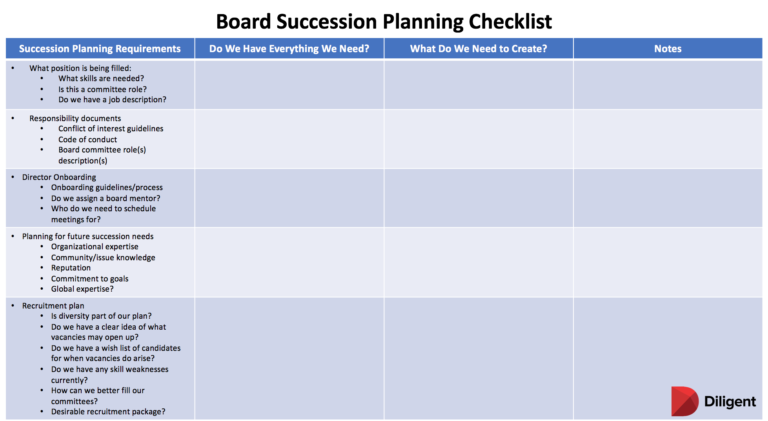

Following is a succession planning checklist for boards and committees:

Fiduciary duties are important all the time — and they’re especially important during the time of succession planning. Boards have a fiduciary duty to investors who expect to be served by a committed and qualified board of directors that is also committed to diversity. Investors are looking for assurance their money is being invested wisely for the short and long terms.

Technology will certainly play an even stronger role moving forward. Boards will need to decide on the best way to incorporate technological expertise on the board. Many boards have overlooked the benefits that technology can offer for the company and the board. Electronic tools of the future haven’t even been invented yet. Boards will want to know that they’re well-educated and positioned to choose the best tools and maximize their dollars to take advantage of the most useful digital programs to help them take the company to the next level.

Succession planning should be driven by board self-evaluations, among other things. Advance planning provides opportunities to detect gaps in skills and abilities and identify areas where boards can encourage training and development for current staff internal advancement.

Governance committees often take the lead in succession planning, with much input from the board chair. Investors and regulators are increasingly asking boards about director succession. Independent board directors will surely play a major role in boards and governance in the near future. Meaningful succession planning will need to factor the company’s stage of development and the expectation and need for adding more independent directors.

The rapid pace of changes in the marketplace, along with technological advancements, ESG concerns and other factors, means that boards should not only establish a succession plan but that they should also review it on a regular basis.

Following is a succession planning checklist for boards and committees:

Diligent’s Succession Planning Tool Is the Modern Approach to Recruitment

The corporate world is shining a big spotlight on diversity and composition in an effort to produce top-quality leadership and to prevent many of the problems of the past. The emphasis on appointing qualified leadership should motivate boards to take a stronger look at their succession planning processes.

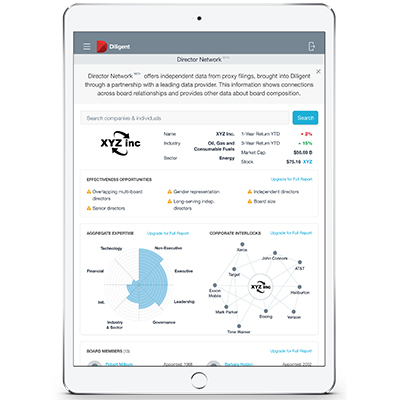

Diligent Corporation has created a digital tool that gives succession planning committees access to information on over 5,500 companies across 24 global markets and 40 indexes. Gain access to the most difficult-to-reach C-level executives and get detailed biographies of over 125,000 executives. Diligent’s Succession Planning tool puts data and analytics at your fingertips to help you spot opportunities to diversify your board and reduce governance risks.

If your succession planning team desires to analyze director interlocks by individual or company, learn about overlapping directorships, detect seats on competing boards, and locate seats on Financial Action Task Force (FATF)-listed companies, Diligent’s Nomination & Governance tool takes care of it all.  With this tool, your succession planning committee gets instant insights into your board’s composition and benchmarks your talent against your competitors. Use the tool to get a detailed breakdown of contributing factors to a board’s effectiveness, including gender diversity, age diversity, director interlocks and overboarding. The tool lets you set granular filter options for experience, demographics, region, sector and discipline. The succession planning tool fully integrates with Diligent Boards and Governance Cloud for even easier access.

Ultimately, the full board is responsible for succession planning. To do it well, they need to establish a succession plan and follow it closely. When it’s been done well, companies keep continuity and momentum as leaders change. When it hasn’t been done well, it leaves them unprepared and ill-equipped to handle crises. With Diligent Nominations, staying on top of succession planning makes quick work of what is otherwise a complex and difficult process.

With this tool, your succession planning committee gets instant insights into your board’s composition and benchmarks your talent against your competitors. Use the tool to get a detailed breakdown of contributing factors to a board’s effectiveness, including gender diversity, age diversity, director interlocks and overboarding. The tool lets you set granular filter options for experience, demographics, region, sector and discipline. The succession planning tool fully integrates with Diligent Boards and Governance Cloud for even easier access.

Ultimately, the full board is responsible for succession planning. To do it well, they need to establish a succession plan and follow it closely. When it’s been done well, companies keep continuity and momentum as leaders change. When it hasn’t been done well, it leaves them unprepared and ill-equipped to handle crises. With Diligent Nominations, staying on top of succession planning makes quick work of what is otherwise a complex and difficult process.