For most organizations, though, there will be multiple shareholders, even multiple subsidiaries with multiple different investors, all of which has a knock-on effect on compliance. Every jurisdiction has different requirements for how an entity in that jurisdiction should be set up and run, from the makeup of the board to the minimum capital needed to be considered a viable business.

And while the topic of ownership structure could have us in discussion for days, we attempt here to shed a little light on the compliance implications of ownership structure. Of course, the first option in all cases should be to discuss this with an expert, either in-house or in a partner firm.

Exploring Ownership Structures and Compliance Implications

While organizations can ' and do ' opt for myriad different ownership structures when growing and operating businesses, there are a few that are more common.Parent-Subsidiary Structure

The parent-subsidiary structure is most common in international businesses or those businesses operating in multiple jurisdictions. It is where one 'parent' company, or a holding company, takes the overview for multiple subsidiaries underneath them. Each entity is closely interconnected through the parent, and an issue in any one subsidiary can cause a headache across all of them.These structures are usually set up for tax or investment purposes, which is why it's important in a group structure to ensure each entity is set up compliantly, actioning all filings and providing all information in a timely manner. As structures get more complex, especially if different owners are introduced to specific subsidiaries but not the parent, it becomes increasingly important to be able to track ownership structures and pinpoint any compliance challenges before they become issues.

Integrated Ownership

Integrated ownership, says Bureau Van Dijk, is a 'catch-all term used to describe the summed percentage ownership by an individual or entity of another entity.' To determine the percentage ownership, one must look at all the intricate paths to that individual or entity, multiplying percentages between each level and adding up the resulting figures for each path. This can be useful for compliance and company valuation.

According to Bureau Van Dijk: 'In some strictly regulated areas of compliance integrated ownership is only partially relevant, as total ownership at particular levels in corporate structures can be more important. But regulations vary from one jurisdiction to the next, rules change, and a big part of compliance is mitigating against reputational risk.'

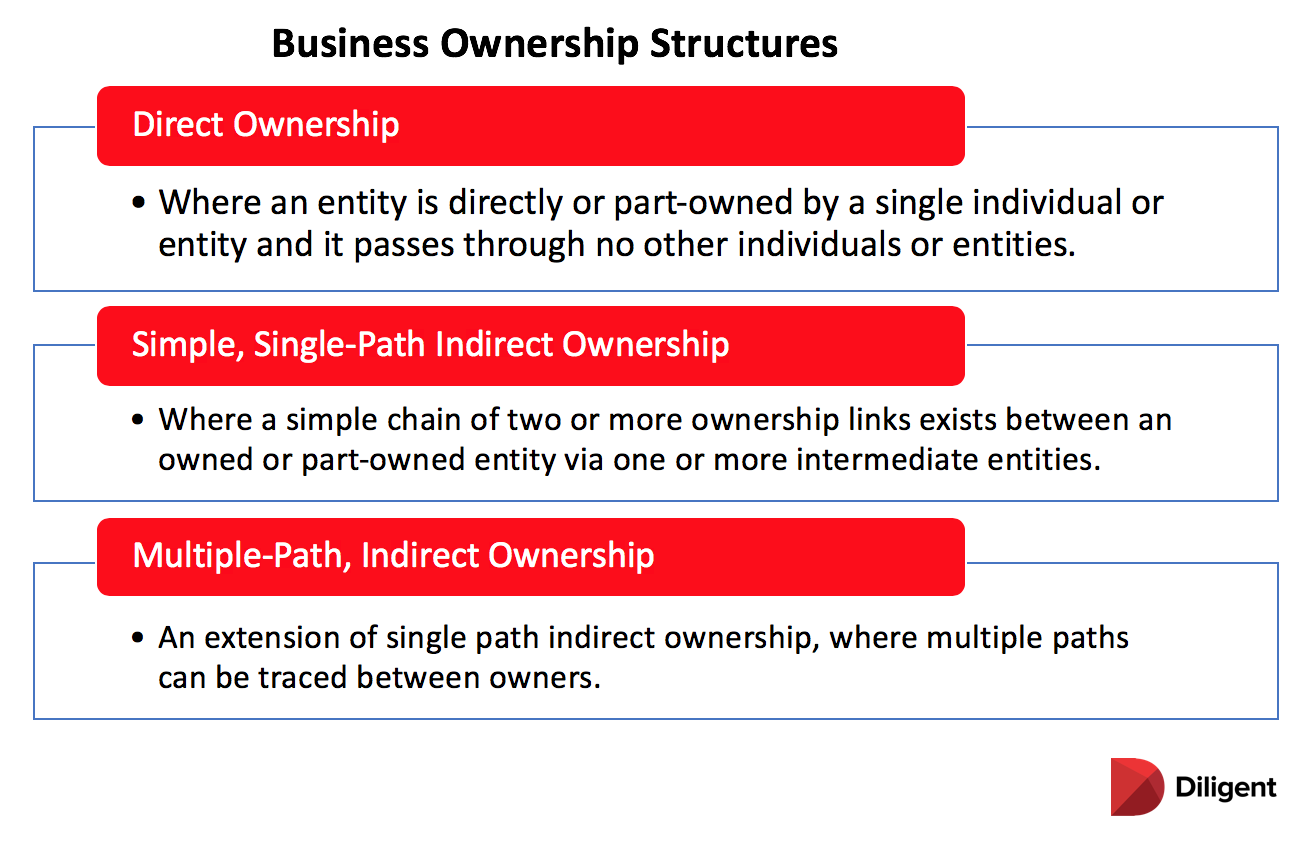

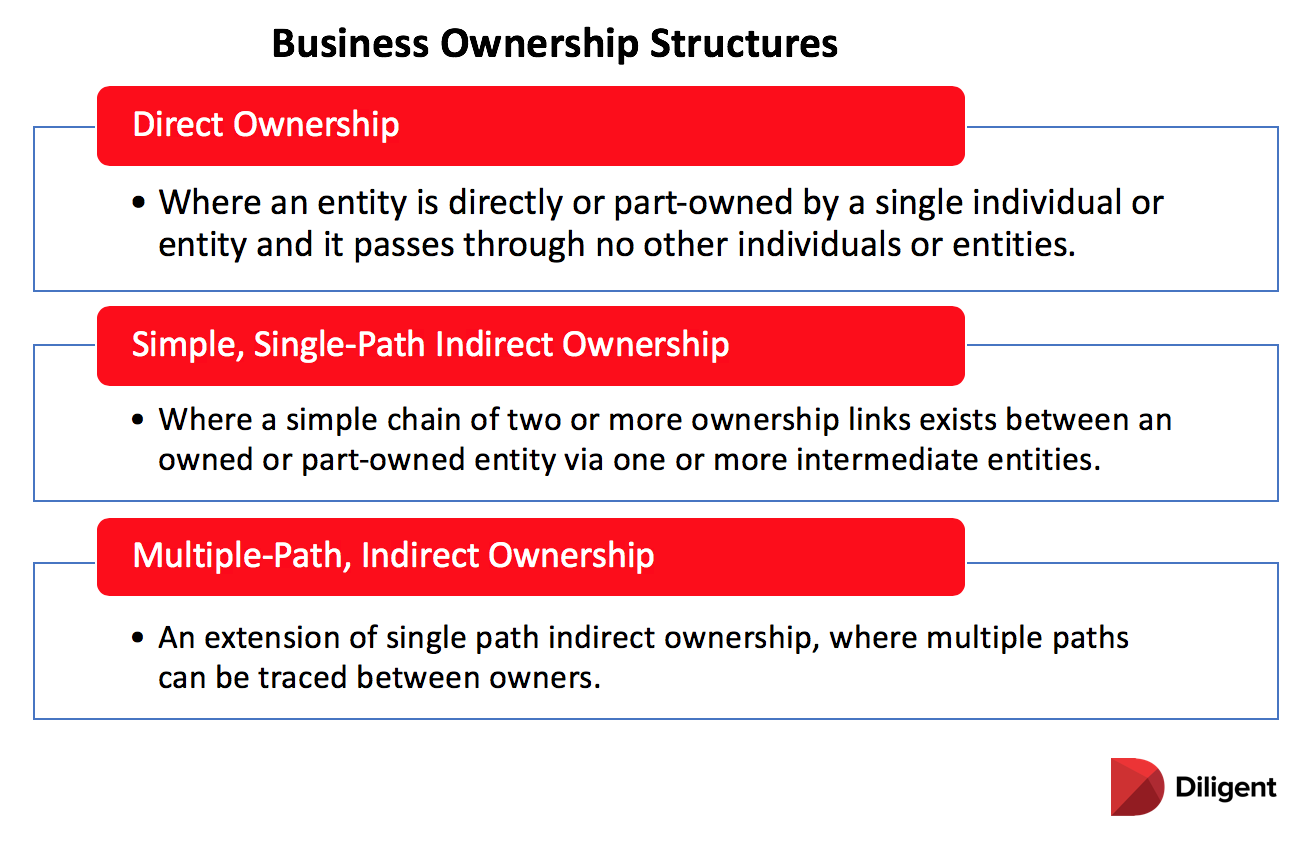

Without wanting to get too in-depth into a complex subject, three relatively simple types of integrated ownership include:

We reference this complex subject purely to highlight one thing: ownership structures are rarely simple, and can cause compliance headaches if they're not closely tracked and recorded.

Capital, Shareholders and Local Compliance

Remember, most jurisdictions will require any new entity to have a minimum level of capital before it can be incorporated. Likewise, there could be requirements in terms of shareholders and board structure, and some may even require there to be an external representative on the board. There may be limits on the integration of boards between parent and subsidiary, or there may be a requirement for a parent's director to sit on the subsidiary's board.This is why it's so important to be clear on the local regulations before choosing where to set up your subsidiaries. You need to ensure that your organization is ready and able to fulfill all ownership and structural requirements before you make your investment, and that it can then track and record all relevant documentation to be able to demonstrate that the ownership structure is compliant.

Don't Forget Your Third-Party Relationships

And don't forget those third parties involved in your organization's operations. While generally 'third parties' are seen in the form of customers, suppliers, agents and distributors ' all of which have compliance implications of their own and require strict due diligence processes ' it's important not to forget the compliance implications of any joint-ventures or strategic partnerships. While they are not strictly 'owners,' these partners do have an impact on the ownership structure.Anyone your organization aligns with, whether officially or unofficially, is seen as an extension of your own business. You have a responsibility for whom you do business with, and any third party's wrongdoings are, by extension, yours in the eyes of anyone reviewing your business conduct and compliance. If a strategic partner is hauled over the coals by regulators, you can bet those regulators will start to take a closer look at any third parties involved in that business, and the light will soon be shone on your own organization.

To help avoid any conflicts here, ensure a full compliance check is performed on any strategic or JV partners. Go through the same motions you would for a KYC check, research the way they do business, and find out whether they're in good standing in all jurisdictions. Check compliance with anti-bribery, money-laundering, counter-terrorism financing and corruption regulations across the whole organization. Don't just stop at the specific entity you will be working with; investigate the full ownership structure, as there may be a rogue trader hidden somewhere in the group. And, of course, remember that the people you're dealing with could ultimately report to a hidden beneficial owner.

The Importance of the Ultimate Beneficial Owner

There is no hiding from this: ownership structures are coming under increasing scrutiny around the world, especially as the Organization for Economic Cooperation and Development (OECD) continues its work into making international business and investment more transparent. That push for transparency is why many jurisdictions ' including most of the world's most desirable corporate homes ' now require regulators to maintain a beneficial ownership register.These registers ' in Europe, they are mandated by the Fourth Anti-Money Laundering Directive ' are designed to shine a light on who ultimately owns an entity or a group structure. The compliance implications of ownership structure here is that nothing can be hidden from the regulators, and compliance managers must be able to present a list of owners whenever the regulators require it, making it increasingly important to maintain an accurate corporate record.

Control Compliance and Get Visibility of Ownership Structure with Entity Management Software

The best way to mitigate these ownership risks and ensure you remain compliant is by retaining visibility of the full ownership structure of your organization ' and the best way to do that is to harness technology such as entity management software that allows entity diagramming. This process not only shows you the organizational chart for your business, but helps to highlight legal structure risks that may have implications for your organization's compliance.Entity management software, such as Diligent Entities, helps to deliver the right information at the right time as part of a modern governance process. When performing an entity diagramming exercise using entity management software as a way to highlight compliance implications of ownership structure, entity and risk managers can not only see the interactions between entities, but also have access to the full corporate record behind those entities ' that means visibility of any directors who may serve on multiple boards, or any duplication of compliance tasks across the structure, or even missing documentation that could cause compliance problems.

Diligent Entities also integrates seamlessly with the board portal and secure document filing system to create the Governance Cloud, enabling access to documentation from across the organization, and breaking down the silo walls that can hinder governance and cause real problems for compliance.

Get in touch and schedule a demo to discover how Diligent Entities and entity diagramming can highlight the compliance implications of ownership structure in your organization ' and help you to mitigate any risks and face the challenges head-on.