When we asked Michelle Edkins, BlackRock's Global Head of Investment Stewardship, where corporate boards need to show the most improvement, her response was clear: boards must do a better job at articulating their long-term strategy.

[blockquote cite="https://boardroomresources.com/episode/investors-board-performance-review-part-3/" source="Michelle Edkins, BlackRock (minute 12:48, Investors Board Performance Review"]So many companies say, 'Our shareholders don't understand us.' Well, who's fault is that? If you're not telling us what you're doing'and how you should be measured against those goals'then it's quite likely that we will be misunderstanding what you're trying to do and holding you accountable for the wrong things[/blockquote]

Edkins is not alone in her request for boards (in conjunction with management) to better communicate the company's long-term plan with a three-, five-, and ten-year time horizon. Yet, the natural reaction from board members is one of caution. How much can we share before we compromise our competitive advantage?

Across all three sessions of our Investors Board Performance Review, major shareholders chimed in with similar feedback. Trian Partners' Ed Garden asked boards to demonstrate greater time spent on company operations with the goal of increasing shareholder value. Edkins also referenced an open letter to S&P 500 CEOs from BlackRock's CEO Larry Fink, which lamented the short-termism of today's corporations and requested that boards and management outline for shareholders 'a strategic framework for long-term value creation' each year.

To ensure that company strategy doesn't fall through the cracks, boards have begun to develop 'strategy committees' in order to continuously assess the organization's goals and tactics for long-term value creation. Earlier this year, our episode with Caroline Tsay (board member with Rosetta Stone and TravelZoo) shed light on the nature of these committees:

[blockquote cite"https://boardroomresources.com/episode/how-digital-natives-are-impacting-corporate-strategy/" source="Caroline Tsay, (Board Member, Rosetta Stone, TravelZoo & Codefresh)"]The [strategy] committee is charged with reviewing and evaluating the company's business strategies and making any recommendations to the rest of the board on potential strategy changes. It's also focused on reviewing and evaluating growth opportunities for the company'anything from marketing and sales to operational strategies and the use of technology.[/blockquote]

Chairing the strategy committee, Tsay describes her role as a conduit between the board and management. Her committee spends more time with members of the management team who may otherwise only have limited access to the board throughout the year. The strategy committee may touch topics including big data, customer segmentation, or hiring new talent, depending on the nature of the organization.

Recently on the blog, we've acknowledged the increasing workloads and time commitments required of today's directors. The board's ongoing assessment of corporate strategy is one area that's requiring increasing time and attention.

'Markets are constantly changing,' said Tsay. 'They're not static. [Strategy has] got to be an on-going topic of discussion.'

DO decide on the talking points that the board will share. Given the sensitive nature of corporate strategy, the whole board should agree on salient talking points that don't compromise the organization's competitive advantage. Every board member should be familiar with these points. ''

DO identify the best directors to engage directly with investors. While every board member should be able to discuss corporate strategy, it's recommended that boards select designated directors who are both comfortable and experienced in external communications.

Throughout our Investors Board Performance Review, major investors like Vanguard, BlackRock, and CalSTRS discuss their expectations for shareholder engagement. Don't miss this exclusive fireside chat with some of the world's most influential institutional investors and proxy advisors.

[blockquote cite="https://boardroomresources.com/episode/investors-board-performance-review-part-3/" source="Michelle Edkins, BlackRock (minute 12:48, Investors Board Performance Review"]So many companies say, 'Our shareholders don't understand us.' Well, who's fault is that? If you're not telling us what you're doing'and how you should be measured against those goals'then it's quite likely that we will be misunderstanding what you're trying to do and holding you accountable for the wrong things[/blockquote]

Edkins is not alone in her request for boards (in conjunction with management) to better communicate the company's long-term plan with a three-, five-, and ten-year time horizon. Yet, the natural reaction from board members is one of caution. How much can we share before we compromise our competitive advantage?

A Look at the Numbers

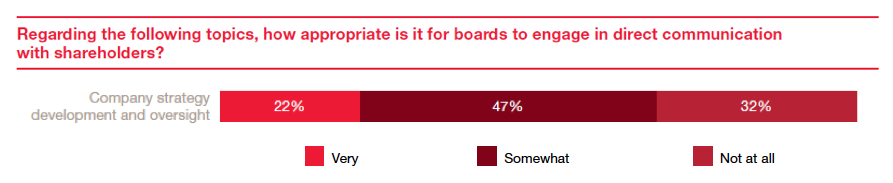

In PwC's recent survey of corporate directors, we begin to see how the board's caution has translated to investor frustration. Of the nearly 900 directors surveyed, 32% indicated the belief that it is 'Not at all' appropriate to discuss company strategy development and oversight. Another 47% indicated that it is only 'Somewhat' appropriate. Yet, investors want details.Across all three sessions of our Investors Board Performance Review, major shareholders chimed in with similar feedback. Trian Partners' Ed Garden asked boards to demonstrate greater time spent on company operations with the goal of increasing shareholder value. Edkins also referenced an open letter to S&P 500 CEOs from BlackRock's CEO Larry Fink, which lamented the short-termism of today's corporations and requested that boards and management outline for shareholders 'a strategic framework for long-term value creation' each year.

What Investors Really Want

Investors want benchmarks. They want targets, milestones, and goals by which board members plan to measure the company's success. Proxy summaries and other shareholder communications are often too backwards-looking, said Fink in his open letter, providing several examples of the kind of strategy disclosure institutional investors are looking for:- How the company is navigating the competitive landscape

- How the company is innovating

- How the company is adapting to technological disruption or geopolitical events

- Where the company is investing

- How the company is developing talent

Rethinking the Board's Approach to Strategy

Too often, the board's discussion of corporate strategy is relegated to a one-time discussion or an annual retreat. These yearly sessions can be insightful; however, they should only be one piece of the board's ongoing strategy discussion.To ensure that company strategy doesn't fall through the cracks, boards have begun to develop 'strategy committees' in order to continuously assess the organization's goals and tactics for long-term value creation. Earlier this year, our episode with Caroline Tsay (board member with Rosetta Stone and TravelZoo) shed light on the nature of these committees:

[blockquote cite"https://boardroomresources.com/episode/how-digital-natives-are-impacting-corporate-strategy/" source="Caroline Tsay, (Board Member, Rosetta Stone, TravelZoo & Codefresh)"]The [strategy] committee is charged with reviewing and evaluating the company's business strategies and making any recommendations to the rest of the board on potential strategy changes. It's also focused on reviewing and evaluating growth opportunities for the company'anything from marketing and sales to operational strategies and the use of technology.[/blockquote]

Chairing the strategy committee, Tsay describes her role as a conduit between the board and management. Her committee spends more time with members of the management team who may otherwise only have limited access to the board throughout the year. The strategy committee may touch topics including big data, customer segmentation, or hiring new talent, depending on the nature of the organization.

Recently on the blog, we've acknowledged the increasing workloads and time commitments required of today's directors. The board's ongoing assessment of corporate strategy is one area that's requiring increasing time and attention.

'Markets are constantly changing,' said Tsay. 'They're not static. [Strategy has] got to be an on-going topic of discussion.'

Tips for Shareholder Engagement

Once the board has established a fluid process for assessing corporate strategy, articulating the company's vision, benchmarks, and tactics should be a natural extension of the conversation. ''DO decide on the talking points that the board will share. Given the sensitive nature of corporate strategy, the whole board should agree on salient talking points that don't compromise the organization's competitive advantage. Every board member should be familiar with these points. ''

DO identify the best directors to engage directly with investors. While every board member should be able to discuss corporate strategy, it's recommended that boards select designated directors who are both comfortable and experienced in external communications.

Throughout our Investors Board Performance Review, major investors like Vanguard, BlackRock, and CalSTRS discuss their expectations for shareholder engagement. Don't miss this exclusive fireside chat with some of the world's most influential institutional investors and proxy advisors.